Women and Wealth

Engaging and Empowering Female Investors to Achieve Their Financial Goals

By 2030, American women will control two-thirds of the nation’s wealth, as part of an unprecedented wealth transfer and demographic shift among the Baby Boomer generation. And yet the prevailing perception among many advisors is that women are more uncomfortable or risk-averse when it comes to investing and financial planning than their male counterparts.

At RKL Private Wealth, we know that “risk-averse” can actually mean deliberate, considerate and thoughtful. There’s a whole range of competing priorities, family dynamics and societal forces that keep women on the sidelines of these important planning discussions. Our goal is to build a personal connection with our female clients and give them confidence to participate in financial discussions and decision-making.

What Matters to You, Matters to Us

Far too often, women are thrown into financial planning during a pivotal moment, such as starting or selling a business, children, divorce, death or caring for a parent. And these moments may come earlier than expected — the average age for U.S. widowhood is 59. As women start to play a bigger role in household financial decisions, whether out of interest or necessity, they tend to prioritize trust, connection and support and will make big moves to find it. Studies show that 70 percent of widows change financial advisors within one year of their spouse’s death.

Our Private Wealth advisors understand this desire for connection because it’s one of our top priorities, too. We start each Private Wealth relationship with big-picture questions about needs, objectives and motivations. Then, we assemble a customized plan from our continuum of services to make it all happen.

Female Advisors Focused on You

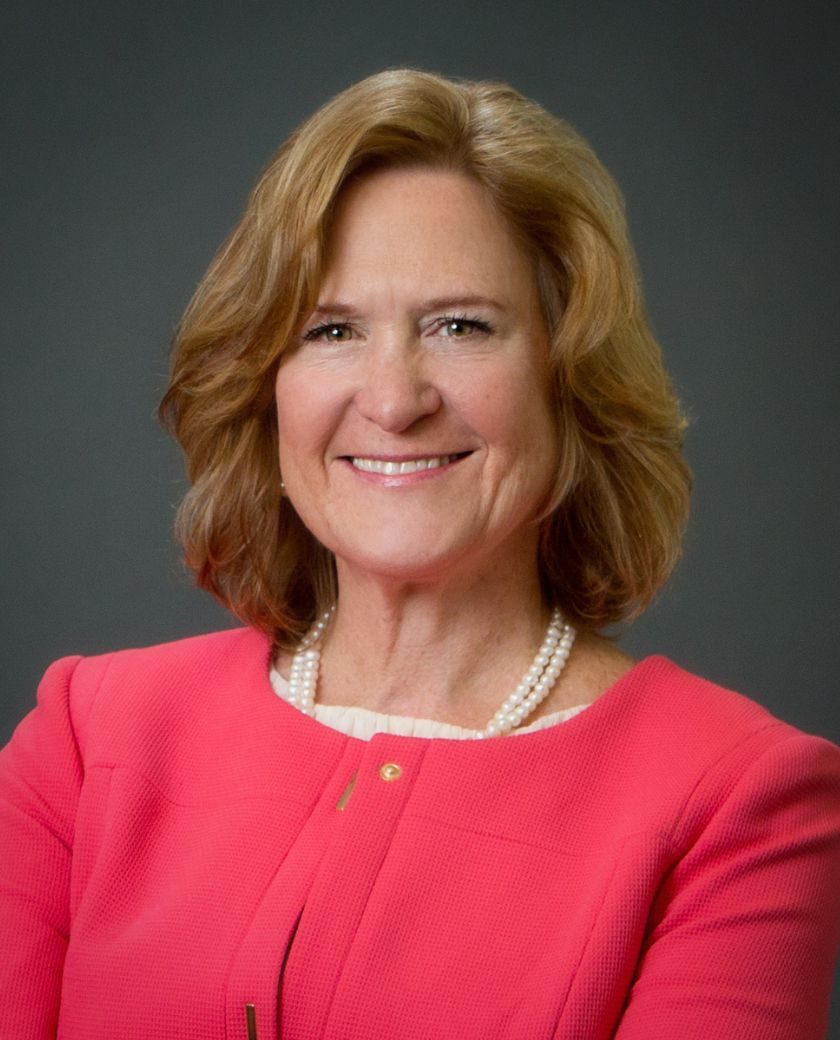

The U.S. financial planning industry remains male-dominated, with women advisors making up less than one-quarter of the profession, according to the Certified Financial Planning Board of Standards. That’s why we’re especially proud that women make up 60 percent of our Private Wealth team, including our Partner/President Laurie Peer.

Our female leadership and bench strength helps us understand women’s unique financial concerns, needs and priorities. We start by listening, learning and building a foundation of shared understanding and trust. Our goal is to increase confidence and connection with your finances. We believe that all women should be empowered and engaged in shaping their own financial destinies.

Our Team's Perspectives

We strive to empower women and help them find a voice when it comes to articulating financial priorities and achieving their goals.

Wellness shouldn’t stop at the mind, body and soul. I’m passionate about helping women extend wellness to their wallets so they’re better prepared for life’s changes and challenges.

Investment advisory services offered through RKL Wealth Management LLC. Consulting and tax services offered through RKL LLP. RKL Wealth Management LLC is a subsidiary of RKL LLP.