You work hard to provide financial security for your loved ones. And so it only makes sense that you want to pass on as much of your wealth as possible to those you hold dear in the event of your death. In Pennsylvania, your estate will be subject to an additional state inheritance tax, so it’s important to understand what options are available to you to minimize your heirs’ tax burden.

Reducing Estate, Inheritance and Gifting Taxes

Here’s what you and your loved ones should know about tax matters related to estates, inheritance and gifting in Pennsylvania.

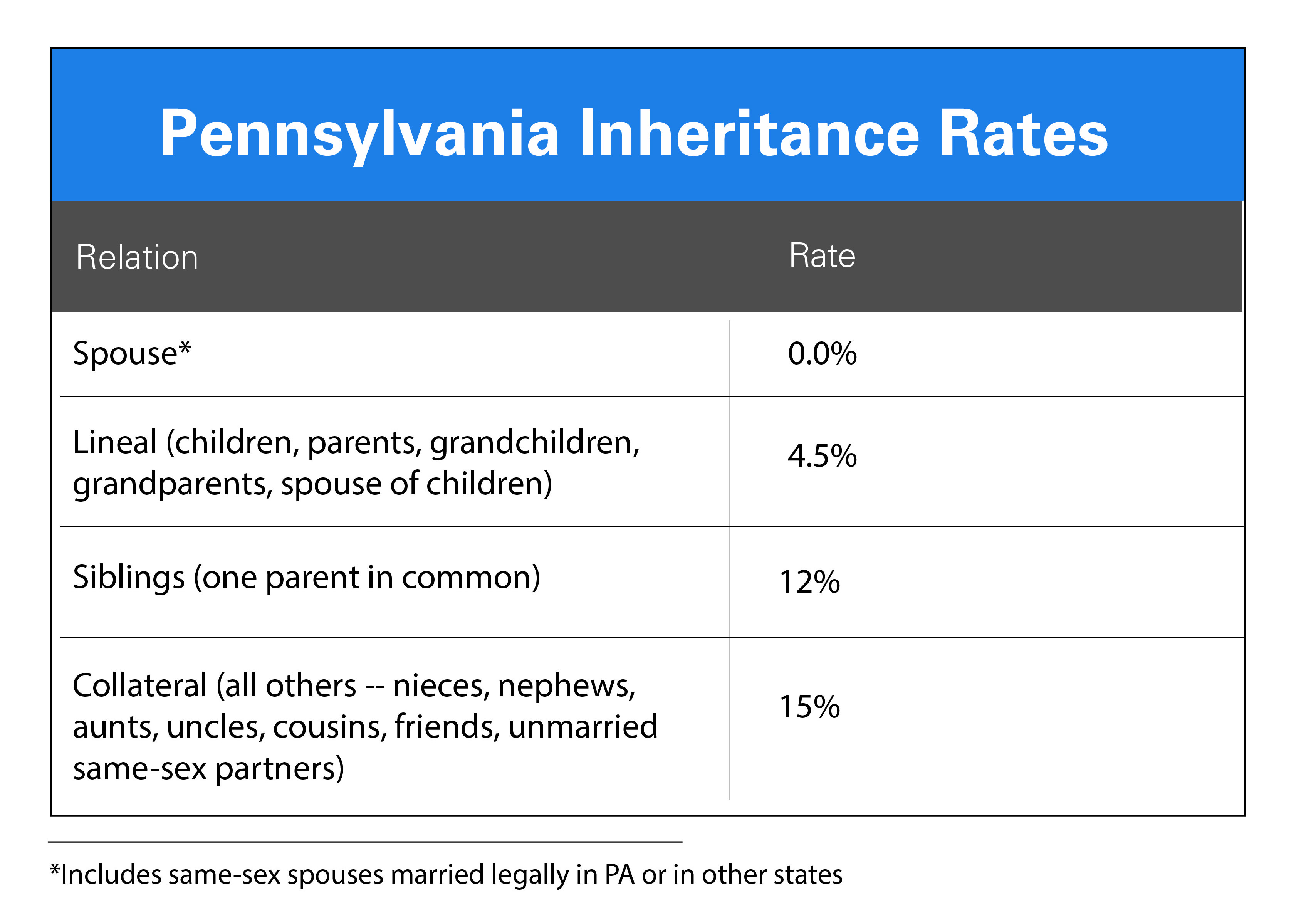

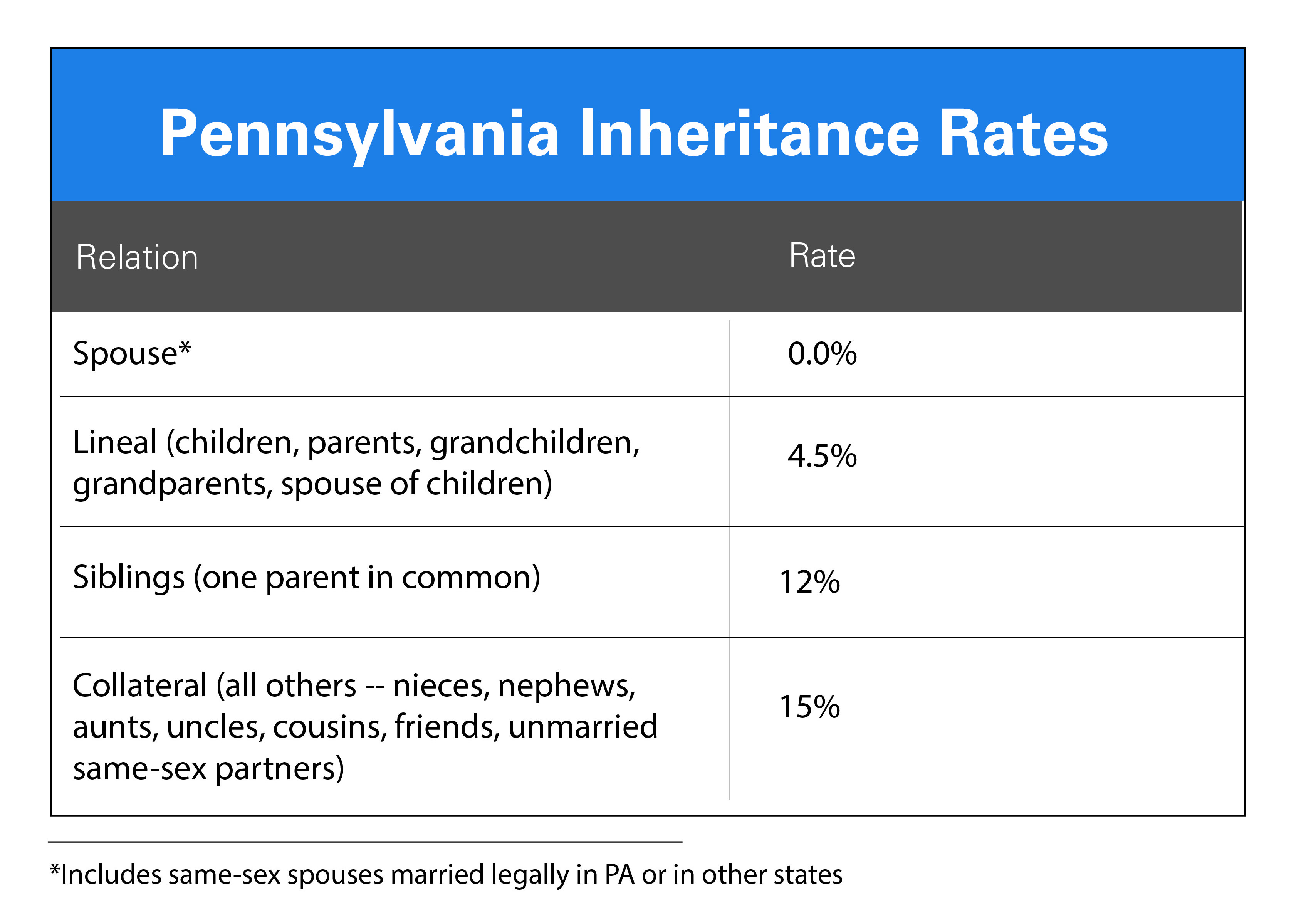

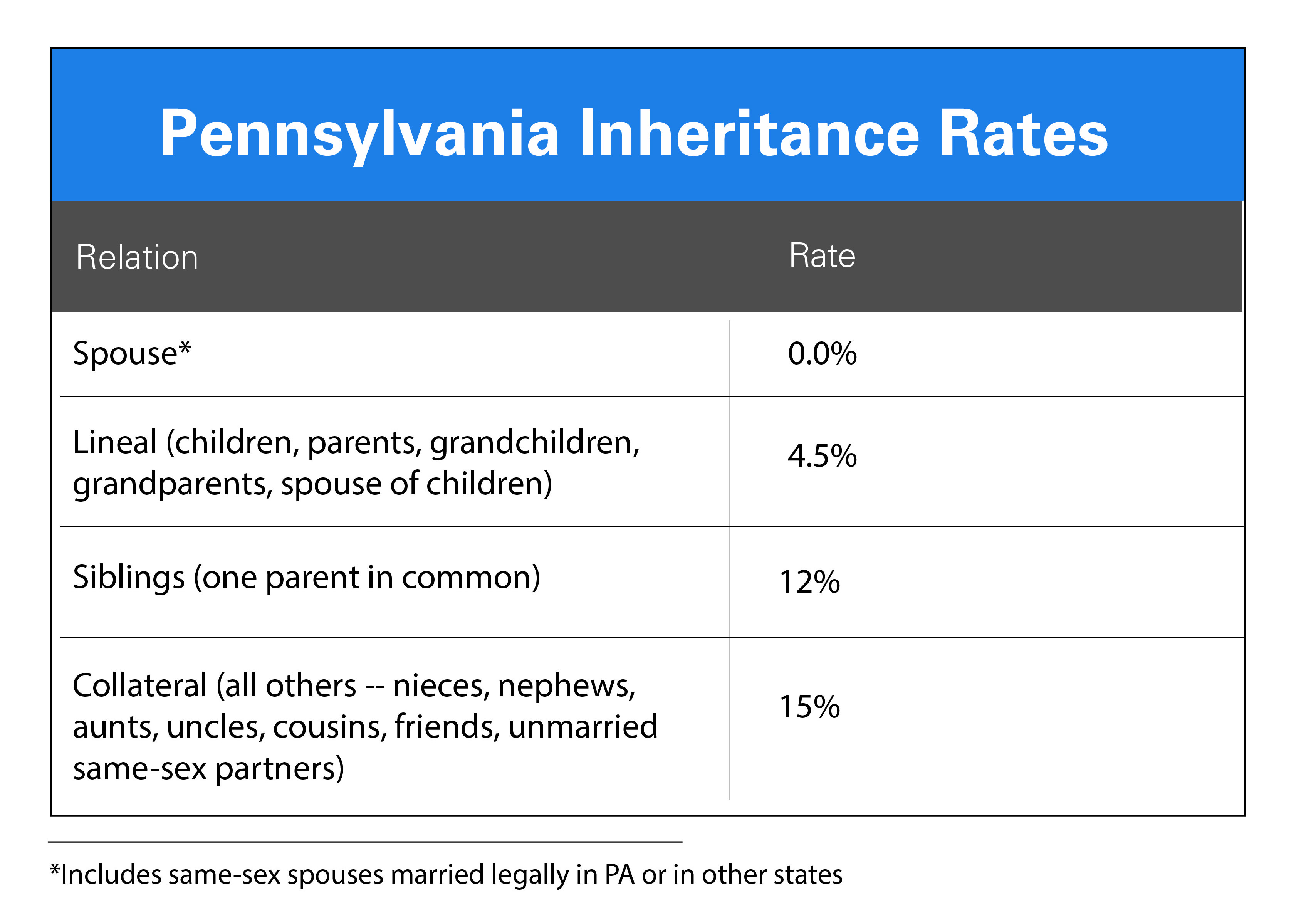

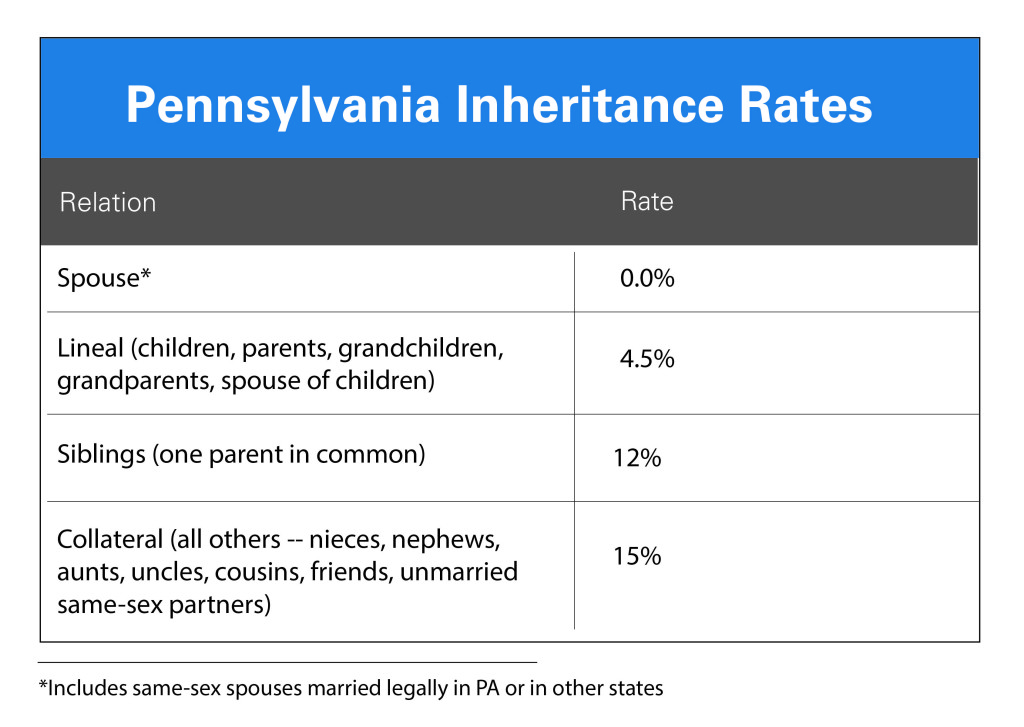

Pennsylvania is one of 19 states and the District of Columbia that levies separate estate taxes on its taxpayers. And the more distant a relative you are, the more you pay.

Pennsylvania is one of 19 states and the District of Columbia that levies separate estate taxes on its taxpayers. And the more distant a relative you are, the more you pay.

- You can get a discount on Pennsylvania inheritance tax. In Pennsylvania, inheritance tax isn’t due until nine months after the date of death, but if you pay the tax within three months, you are eligible for a five percent discount on your inheritance tax. Most attorneys are aware of this provision and will advise you accordingly.

- You can give $3,000 tax-free within a year prior to death in Pennsylvania. Terminally ill individuals in Pennsylvania may want to consider gifting each of their loved ones up to $3,000 – the maximum amount of gifts within a year of death that would not be added back as part of the taxable estate.

- You can give up to $14,000 a year tax-free without it counting against the federal lifetime exemption of $5.34 million. This is the maximum amount that you can gift to each loved one within any given year without filing a federal gift tax return.

Have questions about gifting and estate tax matters? RKL is here to help. Contact your RKL advisor today or one of our local offices.