In the realm of entrepreneurship, the allure of franchising often shines brightly. The promise of established brand recognition, proven business models and ongoing support can be compelling. However, one critical…

Recent Insights

Nine Reasons Your Employee Handbook Deserves an Annual Review

As a human resources or organizational leader, you know that your employee handbook is the cornerstone of your company’s HR framework, serving as a vital tool for communicating company policies…

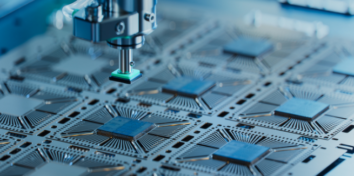

Navigating the Cybersecurity Landscape in Manufacturing and Distribution

The manufacturing and distribution sectors stand as the backbone of the global economy, intertwining complex supply chains, innovative technology and extensive data management. However, with the rise of digital transformation,…

The Mystery of the Shrinking Pay Gap: Strategies to Combat Wage Compression

In most cases, a shrinking pay gap is a cause for celebration, except in the context of wage compression. Much like a magician’s subtle sleight of hand, wage compression baffles…

The Battle Over IRS Penalties: Understanding the Farhy v. Commissioner Decision

In 2023, the United States Tax Court issued a ruling in Farhy v. Commissioner stating that the IRS lacked the authority to assess and issue penalties directly for failing to…