Comparing Pre-Tax Deferrals and Roth 401(k) Deferrals

Participant Informational Sheet: Comparing Pre-Tax Deferrals and Roth 401(k) Deferrals

When participating in a 401(k) plan, you may have the option to choose between Pre-Tax Deferrals and Roth 401(k) Deferrals. Understanding the differences between these options can help you make informed decisions about your retirement savings strategy.

Pre-Tax Deferrals (Pay Federal Taxes Later)

- Contributions are made with before-tax dollars, reducing your Federal taxable income for the year.

- Taxes on contributions and earnings are deferred until you withdraw funds during retirement.

Benefits

- Immediate tax reduction: Lower taxable income in the year contributions are made.

- Potentially lower tax bracket in retirement: If you anticipate being in a lower tax bracket when you retire, pre-tax deferrals can be advantageous.

Considerations

- Tax liability in retirement: Withdrawals are taxed as ordinary income, which could impact your tax situation if you’re in a higher tax bracket.

- Your employer contributions are contributed to pre-tax.

Roth 401(k) Deferrals (Pay Federal Taxes Now)

- Contributions are made with after-tax dollars, meaning you pay Federal taxes on the contributions upfront.

- Earnings grow tax-free, and qualified withdrawals are tax-free.

Benefits

- Tax-free withdrawals: If you expect to be in a higher tax bracket in retirement, Roth deferrals can be beneficial.

- No required minimum distributions (RMDs) during your lifetime if rolled over to a Roth IRA.

Considerations

- No immediate tax reduction: Contributions do not reduce your current taxable income.

- Eligibility for tax-free withdrawals: Must meet certain criteria, such as being at least 59½ years old and having held the account for at least 5 years from the first deposit.

Conclusion

Choosing between Pre-Tax and Roth 401(k) Deferrals depends on your current financial situation, tax considerations, and retirement goals. Consider consulting with a financial advisor to determine which option aligns best with your long-term strategy.

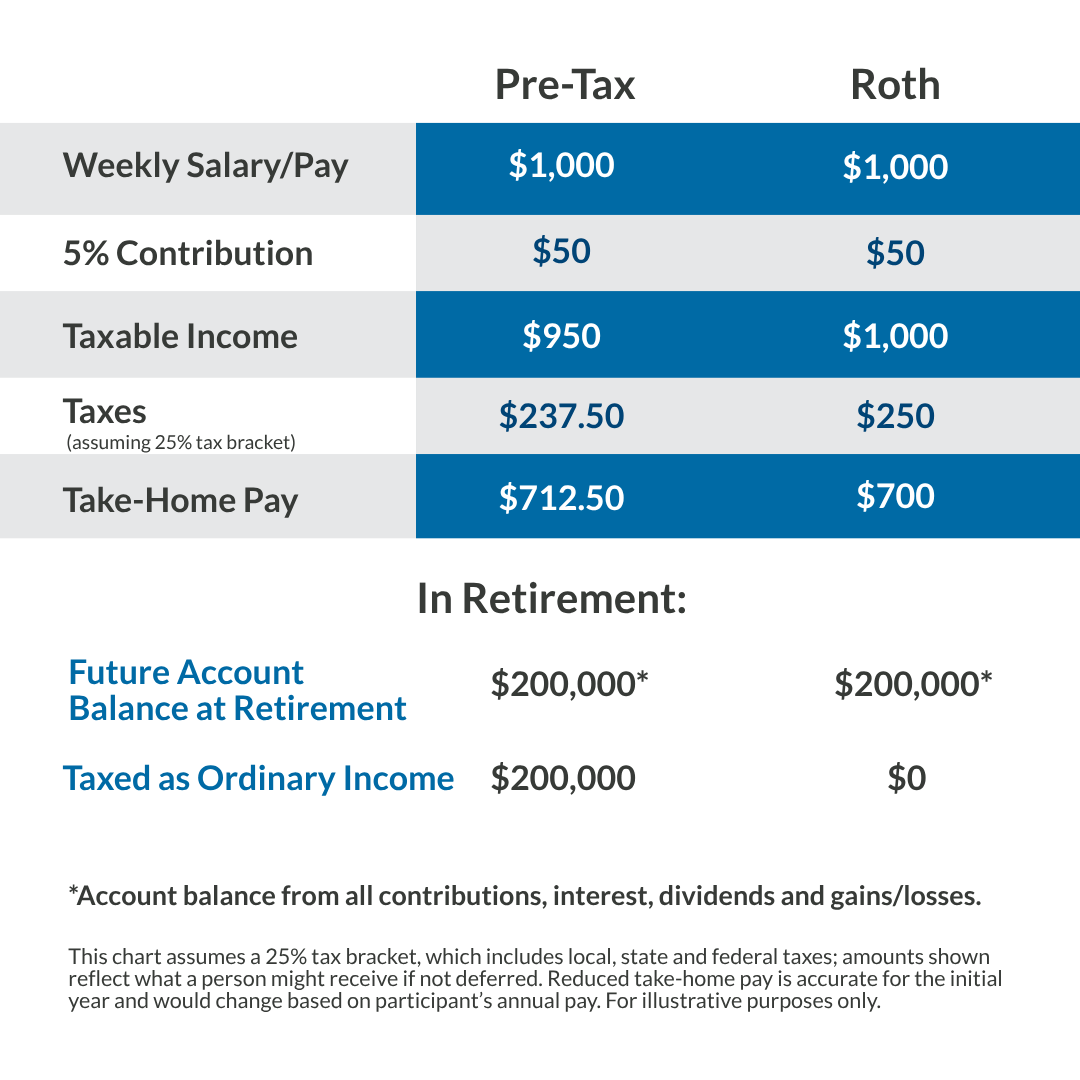

Sample Illustration Comparing Pre-Tax Money and Roth Money

Additional Resources

IRS guidelines on 401(k) contributions: Roth comparison chart | Internal Revenue Service

Source: irs.gov