Now that the One Big Beautiful Bill Act (OBBBA) is law, you have several opportunities to review your state and local tax (SALT) plans with your advisor and make adjustments regarding items that remain in place or have changed.

Pass-Through Entity Tax Planning (PTET)

As of July 30, 2025, 36 of the 41 states that impose personal income tax, plus New York City, have PTET regimes, which allow state income taxes to be paid at the entity level for qualifying pass-through entities, making them fully deductible for federal purposes, and thus bypassing the SALT cap on individual returns.

States use either a deduction or credit method for PTET purposes. The chosen method changes the way the benefit works, but making a PTET election is generally beneficial if you are a resident of a state with such an election.

Deduction Method

A minority of states use the deduction method, which treats PTET payments as a business expense, making payments fully deductible on your business’s federal tax return. This results in receiving a reduced federal pass-through income, lowering your federal tax liability. The states that use this approach effectively treat the pass-through entity as if it were a C corporation.

Credit Method

Under the majority credit method approach, your business pays state tax, and you report your full share of income on your state return. With this method, you receive credit for your share of tax paid by your business, and your company also deducts the tax at the federal level, reducing the pass-through income.

Pennsylvania and PTET

Pennsylvania does not have a PTET system as of July 14, 2025; however, the state does allow an out-of-state credit for S corporation owners. This means the PTET election in states outside of Pennsylvania could benefit Pennsylvania residents who own S corporations.

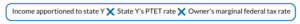

The approximate benefit of making a PTET election in each state can be calculated using the following formula:

For example, Company X is a partnership owned by two people, one a resident of Ohio and the other a resident of Maryland. Company X is eligible to make the PTET election in all states that have enacted PTET systems.

In 2025, Company X has $5,000,000 of federal taxable income: California apportioned income is 50%, California’s state PTET rate is 9.30%, and the owner’s marginal federal rate is 37%. In this scenario, the PTET benefit would be approximately $86,025:

The example above shows how such elections can benefit taxpayers. However, various compliance and tax items could complicate the PTET election analysis. Therefore, detailed modeling should be completed before taxpayers decide on PTET elections.

SALT Cap Planning

Under OBBBA, the SALT cap deduction increased from $10,000 to $40,000 for tax year 2025 and gradually increases through 2029 before reverting to $10,000 in 2030.

Specific modified adjusted gross income benefits include:

- Households with modified adjusted gross incomes under $500,000 get the full benefit while the deduction is phased out.

- Households with modified adjusted gross incomes over $500,000 get a deduction not below $10,000.

- The enhanced deduction is fully phased out when modified adjusted gross income exceeds $600,000.

If you live in a high-tax state, this increase creates tax planning opportunities for you. When planning, here are some things you should consider:

- Prepaying property taxes.

- Making estimated state income tax payments in December rather than January.

- Bundling personal property taxes (e.g., vehicle registration fees) if 2025 will be a high-income year.

- Using a non-grantor trust1 structure for “stacking” SALT deductions.

- Evaluating residence before the 2030 sunset.

- Evaluating the effective tax rate of income earned over $500,000, including whether earning such income is attractive.

- Itemizing rather than using the joint filer $30,000 standard deduction (when combined with mortgage interest and charitable contributions).

- The phaseout’s impact on your effective tax rate on income earned over $500,000*.

* This example is for married individuals who file a joint return.

The $100,000 increase in AGI results in $130,000 more taxable income, due to the lost $30,000 deduction. Multiply that by the 35% bracket, and it results in $45,500 more in federal tax, which is a 45.5% effective tax rate on that additional income.

PTET elections and the enhanced SALT cap are just a few of the planning opportunities that are available to you now that the OBBBA was enacted. RKL’s team of SALT experts provides the support and expertise needed to manage these planning opportunities with confidence. Our services are designed to help business owners like you optimize tax efficiency and compliance. Learn more about RKL’s SALT services or contact your RKL advisor for more information.

1A distinct legal entity that files its own tax return. Each trust can claim the SALT deduction, independent of the grantor’s personal limit. There could be opportunities for certain taxpayers to take advantage of the increased SALT cap by using these structures and transferring, for example, real estate to the non-grantor trust.