With the passing of the One Big Beautiful Bill Act (OBBBA) on July 4, 2025, large businesses1 may see significant tax savings and be able to take advantage of accelerated depreciation methods. This bill eliminates certain required deductions while allowing businesses to deduct certain expenses from their taxable income without affecting the amount of business interest they can deduct.

What Changed?

Adjusted Taxable Income

The OBBBA changed the definition of adjusted taxable income.

- Under the Tax Cuts and Jobs Act, businesses were required to deduct depreciation, amortization or depletion to determine their adjusted taxable income for years beginning on or after January 1, 2022.

- With the OBBBA, businesses are no longer required to deduct depreciation, amortization or depletion to determine their adjusted taxable income, effective for tax years after December 31, 2024.

Accelerated Depreciation Methods

Businesses can take advantage of bonus depreciation and Section 179 without decreasing the business interest expense they can deduct. Using specific depreciation methods will improve their tax benefits.

What Does This Look Like?

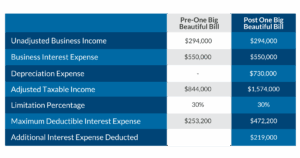

The table below shows what this change in interest expense deductions could look like for large businesses.

If you own a large business, schedule an appointment with your tax advisor to discuss these changes, determine how they may affect your business and decide on any changes that should be made to future tax planning.

1 A business is considered a large business if its average annual gross receipts for the previous three years exceed the threshold that is set by the Internal Revenue Service. The threshold amount is $31,000,000 for 2025.