Key Points

- The stock market has continued to rise despite concerns about tariffs and inflation.

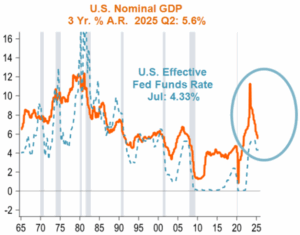

- Rates are still below nominal GDP growth and future interest rate cuts are expected.

- Annual U.S. capital expenditure (capex) investment is approximately $3.4 trillion; full expensing is expected to lower corporate tax burdens in near-term.

Capital Expenditures (Incentives)

Since our last Market Reflections update, the market has continued to climb the proverbial “wall of worry,” despite ongoing concerns about tariffs and inflation. Over the past few months, we have observed brief periods of volatility returning to the market; however, these episodes were short-lived, and the stock market continued its upward trajectory. The graph below illustrates a spike in volatility in early August, driven by escalating trade tariffs and weakening U.S. economic data. Nevertheless, volatility has generally decreased since our previous update. The S&P 500 Index rose another 4% and now sits at 6,584.29 as of September 12, 2025.

(Source: Bloomberg, as of September 2, 2025)

In this Market Reflection, we would like to focus on potential positive developments for the U.S. economy as we move into the fourth quarter of 2025 and into 2026. Previously, our discussions centered on potential risks to the U.S. economy and stock market and how RKL’s investment team proactively manages these risks within client portfolios. While these risks remain relevant, we now wish to highlight possible growth drivers for U.S. GDP.

Changes Under the One Big Beautiful Bill Act

Since the passage of the One Big Beautiful Bill Act, one of the most significant changes has been the full expensing of capex from 2025 to 2028. Research indicates that the current annual investment in U.S. capex is roughly $3.4 trillion. Even if capex spending remains steady in the coming years, the full expensing of capital expenditures is expected to lessen current cash tax burdens on public companies which frees up cash for other purposes.

We view this as a positive for U.S. GDP for several reasons. Capex spending represents an investment in the future, which typically results in higher productivity growth, increased profitability and an overall rise in potential GDP.

Interest Rate Environment

There is ongoing debate in the financial press regarding whether interest rates are “restrictive.” The Federal Reserve’s key interest rate—the federal funds rate—peaked at 5.50% in July 2023 and remained at that level until late 2024. Since then, the Federal Reserve has lowered interest rates by a cumulative 100 basis points (1%).

A key chart our team monitors plots the movements of nominal GDP and the federal funds rate over time. This chart is particularly useful in inflationary environments, as historically, the Federal Reserve has needed to raise its key interest rate above the nominal GDP growth rate for the U.S. economy to enter a recession. Over the past year, nominal GDP has trended lower as the Federal Reserve raised its key interest rate, but the federal funds rate has not yet exceeded nominal GDP. Furthermore, as mentioned above, the Federal Reserve has now cut rates by 1% (100 basis points) from the peak of 5.5%, and the market anticipates additional cuts by year-end.

(Source: Piper Sandler, Macro Research, Economics, September 2025)

Bigger Picture

No single chart or graph can consistently forecast the performance of the economy or stock market. However, during any economic period, certain key indicators can help us better understand our position in the economic cycle. High-frequency economic data clearly shows that we are experiencing at least a “soft patch,” with U.S. real GDP slowing and labor market data softening. Generally, a slowing economy increases the probability of a recession, but we believe the current state of the labor market does not provide a complete picture of the economy. Our focus is on factors that could drive marginal changes in business and consumer behavior. We believe that incentives for capital expense depreciation and a potentially lower interest rate environment could be important drivers of growth as we move into 2026.

Disclosure

Past performance does not guarantee future results. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. The views and strategies described may not be appropriate for all investors. This material should not be relied on for, accounting, legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. Investing involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

Investment advisory services offered through RKL Wealth Management LLC. Consulting and tax services offered through RKL LLP. RKL Wealth Management LLC is a subsidiary of RKL LLP.