Key Points

- The S&P 500 has rebounded sharply from its early-year decline, reaching new all-time highs and delivering over 17% returns year-to-date. U.S. Large-Cap stocks continue to outperform Mid- and Small-Cap stocks.

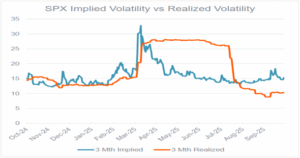

- While realized volatility has decreased, implied volatility is rising, indicating increased investor demand for call options.

- Elevated stock valuations and shifting market dynamics underscore the importance of ongoing risk management and portfolio rebalancing to maintain target allocations and prepare for potential volatility.

Market Update

As we have noted in previous reflections, if you only recently reviewed your investment portfolio, you may not realize how volatile the stock market has been in 2025. Following an almost 20% market drawdown at the beginning of the year, the S&P 500 Index (SPX) experienced a sharp V-shaped recovery and continues to reach all-time highs (6,906 as of October 29, 2025). Year-to-date, the SPX has returned over 17%, with the top 10 stocks in market capitalization size (which are mostly technology stocks) driving the majority of the returns. U.S. Large-Cap stocks continue to outperform both Mid- and Small-Cap indices. Despite our bullish outlook for the stock market in 2025, our team did not expect returns to remain at such elevated levels, especially considering the SPX returned over 20% in each of the last two years.

Our outlook for the U.S. economy remains unchanged, indicating no near-term recession and recognizing potential economic tailwinds that could support growth heading into 2026. However, we also acknowledge that stock market valuations are at historically high levels, which can create environments where, if growth expectations are not met, market pullbacks may occur.

Therefore, despite our continued call for no recession, we are prepared to rebalance portfolios—selling stocks and buying bonds or cash—if stock allocations rise meaningfully above target levels. Our expectation is that the stock market will continue to move higher, and, if we are correct about the potential growth tailwinds into 2026, additional rebalancing efforts may be required.

Stock Market Structure Changes

Since the SPX recovered from the early-year sell-off, the relationship between different types of calculated volatility has changed significantly. When traders discuss volatility, they typically refer to two types: realized and implied volatility.

- Realized volatility is calculated by examining the actual ups and downs of the stock market over a given period.

- Implied volatility is based on traders’ predictions of future market movements, often derived from the derivatives (options) market.

Examining recent data, we observe that since the March sell-off, implied volatility has been trending lower, while realized volatility remained elevated for several months. More recently, as the major volatility from the March sell-off has faded (considering a three-month time horizon), we have seen a shift: implied volatility is increasing even as realized volatility continues to decline.

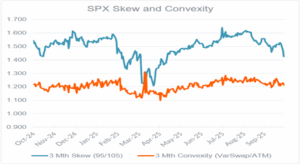

There could be several explanations for this trend reversal, but we believe the primary driver is that investors expect the equity rally to continue into 2026. A deeper analysis of implied volatility valuations reveals increased demand for call options, which benefit from rising stock prices. This conclusion is supported by the skewness of the SPX, which indicates that traders are less concerned about a near-term sell-off, as put option prices have become less expensive. The chart below illustrates how SPX skewness (blue line) has moved lower in the near term.

Investor Implications

The structural changes in the equity market described above are just one data point and do not, by themselves, predict future trends. However, we believe they support our near-term U.S. economic outlook. We see two main implications for portfolios:

- Positive Market Outlook:The recent structural evolution in the stock market is a positive sign of continued market growth. Potential economic tailwinds—such as Federal Reserve rate cuts, increasing capital expenditures and a resilient consumer—could lead to further expansion in corporate earnings.

- Risk Management:Our focus on risk management within client portfolios remains a priority. We plan to rebalance client portfolios more frequently, acknowledging elevated stock valuations and the potential for volatility to re-emerge quickly.

Disclosure

Past performance does not guarantee future results. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. The views and strategies described may not be appropriate for all investors. This material should not be relied on for, accounting, legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. Investing involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

Investment advisory services offered through RKL Wealth Management LLC. Consulting and tax services offered through RKL LLP. RKL Wealth Management LLC is a subsidiary of RKL LLP.